Corporate Tax Services in Dubai, UAE

At VA Zone, we provide professional corporate tax services in the UAE, led by experienced consultants who assist businesses with tax registration, assessment, and return filing. With the implementation of corporate tax, the UAE’s regulatory framework is undergoing significant changes, making it essential for companies to stay compliant and well-prepared for the new tax environment.

Table of Contents

Why Do You Need Corporate Tax Services in the UAE?

As of June 1, 2023, the UAE introduced a federal corporate tax system, marking a significant policy shift aimed at aligning with international tax standards, particularly those set forth by the OECD’s Base Erosion and Profit Shifting (BEPS) framework, including Pillar Two rules for large multinational entities.

Understanding the New Corporate Tax Framework in the UAE

0% tax rate for annual taxable income up to AED 375,000 (encouraging small business growth)

9% tax rate on taxable income exceeding AED 375,000

Minimum tax rate of 15% for qualifying multinational corporations with consolidated global revenues exceeding EUR 750 million, as part of the OECD’s global minimum tax initiative.

This regulatory shift demands that businesses of all sizes—locally owned SMEs or multinational subsidiaries—accurately assess, plan, and comply with the new tax obligations.

✅ Why Professional Corporate Tax Services Are Essential

Navigating this new tax regime requires both technical expertise and ongoing regulatory awareness. Corporate tax service providers in Dubai and across the UAE offer specialized support to ensure businesses comply and thrive under the new system.

Key Benefits of Engaging Corporate Tax Professionals:

📊 Accurate Tax Assessment and Filing:

Specialists ensure precise computation of taxable income, application of relevant deductions/exemptions, and timely filing with the Federal Tax Authority (FTA)—minimizing errors and audit risks.📉 Optimized Tax Planning Strategies:

By identifying potential incentives, exemptions, and structuring opportunities, tax consultants help reduce overall tax liability while staying within legal boundaries.📚 Compliance with Complex Tax Laws:

Regulations can be intricate, especially with cross-border operations or multiple income streams. Tax advisors interpret these laws correctly and keep businesses up-to-date with amendments.⚠️ Risk Mitigation & Penalty Avoidance:

Non-compliance may result in hefty fines, reputational damage, and disruption to business operations. Professional support ensures your business stays compliant.📈 Strategic Business Insights:

Tax advisors offer valuable insights into the tax implications of mergers, acquisitions, restructures, or international expansions, enabling smarter financial decisions.✅ One-Stop Tax Solution Provider:

Top-rated firms like BMS Auditing, Vazone, and other FTA-approved tax consultants offer end-to-end services, from initial tax assessment to return filing, audits, and advisory services.

The Business Imperative in 2024 and Beyond

With the UAE corporate tax now fully enforced, companies are prioritizing.

Building internal tax documentation systems

Aligning financial strategies with tax laws

Streamlining reporting practices for future audits

Each taxable entity is mandated to file one corporate tax return per tax period, along with relevant supporting schedules. This single return simplifies the process but heightens the importance of accuracy and documentation.

Corporate tax services typically include:

| Service Type | Description |

|---|---|

| Tax Registration | Registering with the FTA and obtaining a TRN |

| Tax Computation | Determining net taxable income based on UAE CT Law |

| Return Filing | Submitting accurate tax returns before deadlines |

| Tax Planning | Structuring transactions to reduce liabilities legally |

| Advisory Services | Expert guidance on cross-border tax matters & compliance |

| Audit Representation | Liaising with tax authorities during audits |

| Policy Training | Educating in-house teams on compliance readiness |

All-in-One Corporate Tax Solutions in UAE

Navigating the newly implemented Corporate Tax Law in the UAE requires an integrated, comprehensive approach—and that’s precisely what all-in-one corporate tax solutions offer. Whether you’re a small enterprise, a large corporation, or operating in a free zone, having access to end-to-end corporate tax support can help you remain fully compliant, reduce tax exposure, and avoid costly penalties.

At leading tax advisory firms like Vazone, expert tax consultants offer tailor-made solutions to address every aspect of your corporate tax journey—from registration to filing and from tax planning to audit support. These services are meticulously designed to comply with the UAE Federal Decree Law No. (47) of 2022 on the taxation of corporations and businesses.

Core Areas Covered Under Corporate Tax Solutions in UAE

Here’s an in-depth overview of what a full-service corporate tax solution includes:

1. General Provisions & Legal Framework

Understanding the legal scope, jurisdiction, and definitions within the UAE’s corporate tax law forms the foundation of any compliant tax strategy.

2. Imposition of Corporate Tax & Applicable Rates

0% for taxable income up to AED 375,000

9% for taxable income exceeding that threshold

Special conditions apply for multinationals under Pillar Two (minimum 15%)

3. Identification of Exempt Persons & Businesses

Tax experts help determine if your entity qualifies as:

A government entity

A government-controlled entity

A qualifying investment fund

A public or private pension fund

A wholly owned UAE subsidiary of a government entity, etc.

4. Determining Taxable Persons & Corporate Tax Base

Professionals assess your business type (mainland, free zone, branch, subsidiary, or foreign entity) to define your corporate tax base and applicable obligations.

5. Free Zone Person Regulations

While qualifying free zone entities may enjoy a 0% rate, they must meet strict requirements (e.g., maintaining adequate substance, deriving qualifying income, and not electing out of the regime).

6. Calculating Taxable Income

This includes:

Determination of accounting income

Adjustments for non-deductible expenses

Inclusion of exempt and non-exempt income

Consideration of capital gains, foreign income, and dividends

7. Treatment of Exempt Income

Expert guidance on what qualifies as exempt income, such as:

Dividends received from foreign subsidiaries

Capital gains on shares

Income from foreign permanent establishments

8. Corporate Tax Reliefs & Incentives

These include:

Small business relief (subject to thresholds)

Business restructuring relief

Participation exemption

9. Allowable Deductions & Expenditures

Support in classifying deductible expenses, such as

Business overhead

Salaries and wages

R&D expenditure

Loan interest (with limits)

10. Transactions with Related Parties & Connected Persons

Transfer pricing rules and arm’s-length principles apply here. Tax advisors ensure that such transactions are documented properly to prevent tax base erosion.

11. Tax Loss Provisions

Assistance in:

Calculating and carrying forward tax losses

Understanding loss limitations

Offsetting group losses (where applicable)

12. Tax Group Formation & Provisions

Eligible UAE entities can form a tax group for consolidated tax filing, with guidance provided on:

Requirements for formation

Nomination of a representative entity

Treatment of inter-company transactions

13. Final Calculation of Corporate Tax Payable

This includes deducting tax credits, applying exemptions, and finalizing the payable tax liability in line with UAE CT Law.

14. Payment & Refund Procedures

Professionals guide you through:

Timely tax payment scheduling

Claiming eligible refunds

Avoiding late payment penalties

15. Transfer Pricing Documentation

In compliance with OECD guidelines, businesses engaging in intra-group transactions must:

Prepare Master Files and Local Files

Submit Disclosure Forms with annual tax returns

16. Anti-Abuse Rules

Advisors help you remain compliant with anti-abuse provisions designed to prevent artificial or contrived arrangements intended to reduce tax liability.

17. Corporate Tax Registration & Deregistration

End-to-end support in:

Registering your business with the FTA

Managing deregistration in case of liquidation, closure, or cessation

18. Corporate Tax Return Filing & Clarification Requests

Each taxable entity must:

File one tax return per period.

Submit all supporting schedules.

Request clarifications or rulings from the FTA when needed

19. Violations & Penalties

Advisors help you avoid:

Late filing penalties

Inaccurate disclosure penalties

Non-payment interest

And offer guidance on how to resolve or appeal any issued penalties.

20. Transitional Rules & Final Provisions

Proper application of transitional rules (e.g., opening balance sheet requirements, legacy obligations) is vital for newly registered businesses or those converting from other tax frameworks.

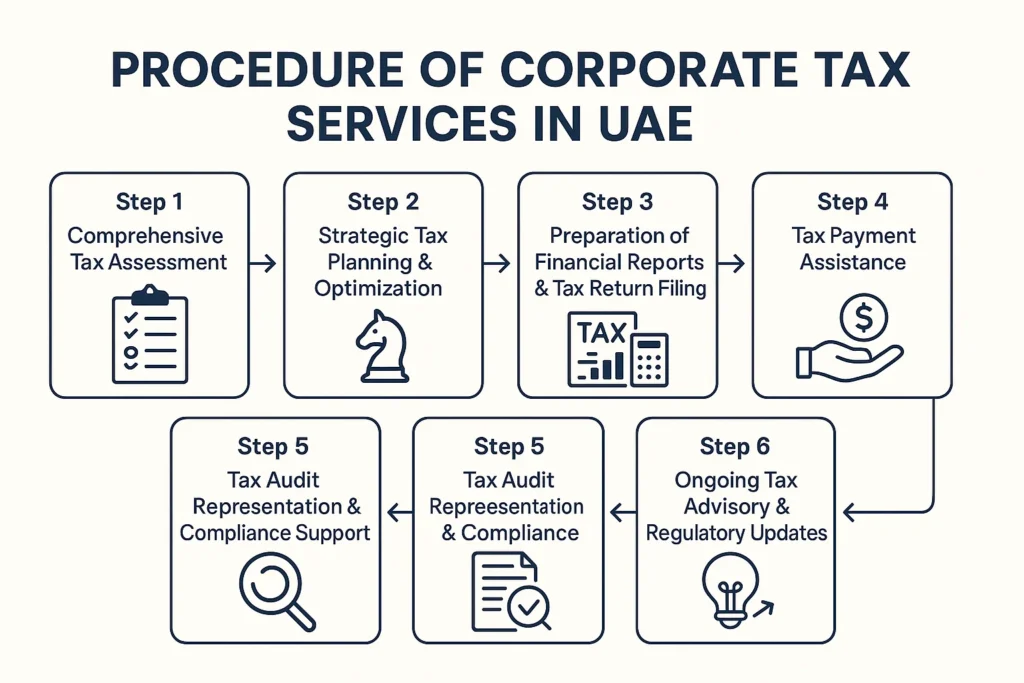

Procedure of Corporate Tax Services in UAE

Successfully navigating the UAE’s newly introduced corporate tax system requires a structured and strategic approach. Professional tax consultants in the UAE offer a step-by-step corporate tax service process that ensures full compliance, accurate reporting, and long-term tax efficiency for businesses operating across various sectors.

Here’s how the corporate tax service procedure typically works:

Step 1: Comprehensive Tax Assessment

Before any filings or tax planning begin, the first step is a thorough evaluation of your business:

Review of financial statements, business models, and operational structures

Identification of taxable income sources, exempt revenues, and special classifications (e.g., free zone entities, related-party transactions)

Determination of applicable tax rates and compliance requirements under the UAE Corporate Tax Law

This phase sets the foundation for accurate filings and strategic planning.

Step 2: Strategic Tax Planning & Optimization

Once the tax obligations are assessed, experts develop a custom tax strategy tailored to your business goals.

Implementation of tax-saving strategies within legal boundaries

Analysis of deductible expenses, group structures, and loss carryforwards

Evaluation of options like tax grouping, relief provisions, or free zone eligibility

Restructuring advice, if necessary, to improve tax efficiency and compliance posture.

Step 3: Preparation of Financial Reports & Tax Return Filing

The next crucial step is the accurate preparation and timely submission of corporate tax returns:

Generation of audited financial statements aligned with UAE accounting standards

Calculation of net taxable income after applying allowable deductions and exemptions

Filing of the Corporate Tax Return and supporting schedules with the Federal Tax Authority (FTA) via the official e-portal

This process ensures you remain in full compliance with FTA deadlines and avoid any penalties.

Step 4: Tax Payment Assistance

Timely and accurate payment of corporate taxes is essential.

Guidance on due dates, installment options (if applicable), and payment methods

Calculation of tax liability to avoid under- or over-payment

Help with managing refunds, if excess tax was paid

Professional support here prevents interest charges or late payment penalties.

Step 5: Tax Audit Representation & Compliance Support

In the event your business is selected for an audit by the FTA:

Your tax consultant will represent your business during the audit proceedings.

Support includes responding to FTA inquiries, compiling documents, and clarifying financial discrepancies.

This representation ensures a smooth and efficient audit process with minimal disruption to your operations.

Step 6: Ongoing Tax Advisory & Regulatory Updates

Corporate tax isn’t a one-time task—it’s a continuous commitment. That’s why UAE-based tax service providers offer

Regular updates on amendments in UAE tax law, including sector-specific guidelines

Continuous compliance monitoring and reporting support

Tailored advice on upcoming business decisions, transactions, or investments with tax implications

This ensures your company stays ahead of compliance requirements and tax-efficient over the long term.

We structure our corporate tax services into six comprehensive phases, ensuring each step of the process is handled with precision and efficiency.

Why Following a Structured Procedure Matters

Without a systematic approach to corporate tax, businesses risk:

Non-compliance and related fines

Missed opportunities for tax relief or exemptions

Poor preparation for audits or regulatory inquiries

By working with experienced, FTA-approved firms like Vazone, businesses in Dubai and across the UAE can enjoy peace of mind, strategic advantage, and full tax law adherence.

Corporate Tax Advisory in UAE

At VAZone, we recognize that every business is unique, from its operational structure and financial goals to its tax exposure and compliance needs. That’s why our corporate tax advisory services in the UAE are not “one-size-fits-all” but strategically customized to fit your specific requirements.

Tailored Tax Advisory for Strategic Business Growth

Our expert corporate tax consultants work closely with clients to assess the nuances of their business models, industry sectors, and transaction types. This enables us to deliver practical, insight-driven tax advice that aligns with both short-term operational needs and long-term strategic objectives.

Whether you’re a startup, SME, or a multinational corporation, our advisory services are built to provide:

Clarity on your corporate tax obligations

Recommendations on optimal tax structures

Guidance on tax-efficient cross-border operations

Risk identification and mitigation strategies

Assistance in making informed, tax-conscious decisions

Full-spectrum corporate tax advisory includes:

Corporate Tax Registration Guidance

We help you register your business with the Federal Tax Authority (FTA) and obtain your Tax Registration Number (TRN)—an essential step for legal compliance.Filing Corporate Tax Returns

Our team ensures accurate and timely return filing through the FTA portal. We also assist with compiling all supporting schedules and documentation required.Real-Time Regulatory Updates & Compliance

UAE tax laws and administrative guidelines are evolving. Our experts stay abreast of the latest updates from the FTA and ensure our clients are always informed and compliant.Penalty Avoidance & Audit Readiness

Through proactive planning and continuous monitoring, we help you avoid non-compliance penalties and stay well-prepared for any FTA audits or inquiries.Custom Advisory Sessions

Need insights on a specific business restructure, new investment, or international deal? Our consultants provide tailored advisory sessions backed by updated regulatory frameworks.

Why Clients Trust VAZone for Corporate Tax Advisory

Personalized Approach: We don’t offer cookie-cutter tax plans. Every recommendation is tailored to your unique needs.

Expertise You Can Rely On: Our certified tax consultants possess deep knowledge of UAE CT law, free zone regulations, and international tax treaties.

Reputation for Excellence: Known for delivering accurate, timely, and trustworthy tax support, VAZone is a preferred name among businesses in Dubai and beyond.

Ongoing Support: Beyond registration and filing, we provide long-term guidance to help you adapt to regulatory changes and plan ahead.

Need Help With Corporate Tax in UAE? Let’s talk.

If you have questions or need expert advice on UAE corporate tax—whether it’s tax registration, return filing, planning, or dispute resolution—you’re in the right place.

Contact VAZone Auditing today or visit our Dubai office for a consultation with our corporate tax specialists. We’re here to ensure your business stays compliant, efficient, and ahead of every tax challenge.

Frequently Asked Questions – Corporate Tax Services in Dubai, UAE

What are tax services and why are they important in the UAE?

Tax services in the UAE help businesses comply with regulations set by the Federal Tax Authority (FTA). These services include corporate tax registration, filing, planning, and advisory, ensuring that companies meet legal requirements and avoid penalties.

Who needs corporate tax services in the UAE?

All businesses operating in the UAE, including mainland and free zone entities with taxable income, should seek corporate tax services to ensure proper registration, accurate tax calculation, and timely filing with the FTA.

What is the corporate tax rate in the UAE?

As of June 2023, the UAE levies a 0% corporate tax on taxable income up to AED 375,000 and a 9% tax on income above that threshold. Multinational companies may be subject to a 15% rate under OECD Pillar Two rules.

What documents are required for corporate tax registration in the UAE?

Key documents include the trade license, Emirates ID, and passport copies of owners, memorandum of association (MOA), and financial statements. A tax consultant can help prepare and submit these to the FTA.

How can a tax consultant help my business in the UAE?

A certified tax consultant offers expert guidance on tax planning, filing, and compliance. They help minimize tax liabilities, avoid penalties, and ensure your business meets all regulatory obligations efficiently.

Latest Posts

Business Consultancy License Dubai Mainland – Cost, Process & Setup | VA Zone

Start a Web3 Business in UAE 2026 | Company Formation & VARA License

SHAMS Free Zone License Cost in Sharjah – 2026 Full Breakdown

SHAMS License Renewal Process in Sharjah – Timeline, Documents & Common Mistakes

Import Export License in Dubai, UAE – A Comprehensive Guide includes Cost, Process & Documents and More

How to Get a General Trading License in Dubai – Complete Guide

SHAMS E-Commerce License – Cost, Requirements & Full Setup Guide (2026)

How to Start a Real Estate Company in Dubai: Complete Step-by-Step Guide (2026)

RAKEZ Free Zone 2026 – License Cost, Business Setup & Visa Services

7 Remarkable Benefits of UAE Golden Visa 2025 – Unlock Your Long-Term Future in the Emirates

IFZA Dubai vs SHAMS Free Zone—Which Is Better for Digital Entrepreneurs in 2025?

Ajman Free Zone vs Fujairah Creative City: Which Free Zone is More Cost-Effective in 2025?

Meydan Free Zone vs IFZA Dubai: Best Free Zone for Startups in 2025